how to calculate nh property tax

New Hampshires real estate transfer tax is very straightforward. New Hampshire Real Estate Transfer Tax Calculator.

Property Tax Information Town Of Center Harbor Nh

The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax.

. Reduce property taxes for yourself or others as a legitimate home business. Understanding Property Taxes in New Hampshire. Ad Reduce property taxes for yourself or residential commercial businesses for commissions.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. This calculator is based upon the state of new. You Report Revenue We Do The Rest.

Taxpayers are able to access a list of various questions pertaining to low and moderate income homeowners property tax relief administered by the New Hampshire Department of Revenue. Property tax rates vary widely across New Hampshire which can be. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Ad Easily File Your Rental Property Taxes. You Report Revenue We Do The Rest. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration.

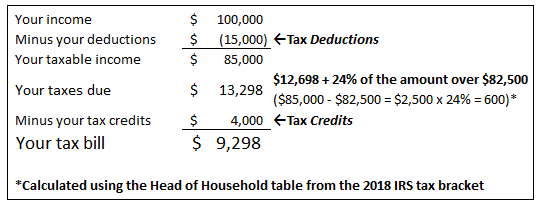

State Education Property Tax Warrant. How to calculate your nh property tax bill. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in.

Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. For comparison the median home value in New Hampshire is.

The assessed value of the property. 186 of home value. Ad Easily File Your Rental Property Taxes.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any. New Hampshires tax year runs from April 1 through March 31. 300000 1000 300 x 2306 6910.

The Assessed Value Multiplied By The Tax Rate Equals The Annual Real Estate Tax. By Porcupine Real Estate Oct 4 2017 Real Estate. Tax amount varies by county.

The local tax rate where the property is situated. How to Calculate Your NH Property Tax Bill. Get Record Information From 2022 About Any County Property.

Ad Find County Online Property Taxes Info From 2022.

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

How To Calculate Capital Gains Tax H R Block

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Nottingham Nh Land For Sale Real Estate Realtor Com

Dmv Fees By State Usa Manual Car Registration Calculator

Business Nh Magazine Nh Named A Most Tax Friendly State

Business Nh Magazine Nh Named A Most Tax Friendly State

How Capital Gains Affect Your Taxes H R Block

Changing Domicile For Tax Purposes Bny Mellon Wealth Management

Real Estate Taxes Gilmanton Nh

What Are State Balanced Budget Requirements And How Do They Work Tax Policy Center

Learn About Taxes And Business Losses H R Block

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans